Written by By Steve LeVine

Vincent Pluvinage, CEO of silicon anode developer OneD Battery Sciences, is on a rant: His fellow next-generation battery makers, he says, are overpromising a future of cheap, faster-charging, long-distance electric vehicles. Pluvinage says automakers will be reluctant to adopt these technologies after sinking billions of dollars into factories devoted to conventional lithium-ion and graphite batteries. As a result, he says, his rivals won’t achieve the high sales they predict this decade, but will be relegated to the niche premium and ultraluxury segments.

The 64-year-old Pluvinage, a Belgian entrepreneur with a doctorate in bioengineering, has personal and economic motives for his claims. His Palo Alto, Calif.-based company, which is developing a battery with General Motors, is competing for future business with the rivals he is denigrating. But he has a point: It will be expensive to switch to next-gen high-silicon anodes, which use costly materials and aren’t yet manufactured at high volume. He argues for moderation—anodes that mix a small amount of silicon with graphite, rather than the 100% silicon anodes others tout as a goal. “The second half of the decade—2024 to 2030—is the era of affordable EVs,” Pluvinage says. “Everything is about economics.”

In a battery, the anode is the holding pen for lithium ions. When you start your EV and press the accelerator, the ions begin to rush from the anode to the cathode, creating a current that propels the vehicle. Almost all current lithium-ion batteries use anodes made entirely of graphite, which is relatively cheap and plentiful. OneD and its rivals have sought to introduce silicon into anodes because its atoms can theoretically hold 10 times more lithium by weight than graphite, giving an EV far greater driving range. Lithium also moves faster through silicon than through graphite, allowing batteries with silicon anodes to charge faster. What has held silicon anodes back is that they lack graphite’s natural pores and layers, causing them to swell and contract enormously when holding and releasing the lithium; after multiple cycles they can crack, destroying the battery. But Pluvinage goes further and says rival companies like Sila Nanotechnologies and Enovix are pushing the bounds of silicon too far.

Over the last dozen years, startups have emerged with competing ways to accommodate silicon’s expansion. Alameda, Calif.-based Sila Nano encloses the silicon in an engineered carbon structure, while Enovix, headquartered in Fremont, Calif., places the silicon within a clamped-steel architecture. OneD uses “nanowires,” tiny hairs of silicon within the graphite that are so small they ostensibly can swell and contract without causing harm. All three companies have battled manufacturing costs that are far higher than those for pure graphite. Sila, Enovix and others have promised that once they are producing at large volume, their costs will drop and eventually rival graphite’s. Pluvinage is skeptical. Because OneD’s changes to the anode are less radical, he says his company will be able to quickly reduce its costs, but that the others are unlikely to see dramatic efficiencies until the 2030s.

The outcome will be crucial for both EV makers and next-gen battery companies. Both groups are fighting to compete and survive. Last week, Ford reported that it had lost more than $2 billion on EV sales in 2022 and would lose another $3 billion this year, illustrating the losses faced by virtually all EV makers with the notable exception of Tesla. There is a greater chance of profit in costly premium EVs, but few consumers can afford them and the segment is crowded. That has forced the automakers into a reckoning—if they want to sell millions of EVs and do it soon, they need to quickly develop profitable vehicles that cost no more than $40,000 and preferably less than $30,000, that can travel 300 miles on a charge and that can charge in around 15 minutes. The next-gen batteries offer a path to all those goals. But it’s not clear which next-gen battery makers will be able to produce what they have promised in the next few years.

As of now, the major automakers have given little indication of their plans. Mercedes has said that it will offer Sila Nano’s anodes as an option for its 2025 ultraluxury G-Class SUVs, and Group14 Technologies, a silicon anode developer based in Woodinville, Wash., has said it will supply Porsche in 2024. These will not be large sales—Mercedes, for example, sold just 2,400 G-Class vehicles in the U.S. last year, less than 1% of its total U.S. sales.

GM has not said whether it will buy Pluvinage’s anodes—a spokesperson told me only that the company is adding increasing amounts of silicon from another supplier to its anodes over time to increase energy density. But Pluvinage is betting he will sell a lot because his anodes will cost the same as graphite ones and won’t require retooling of the factory equipment that EV makers currently use. “Every [automaker] has to look at its own survival,” he said.

Hunt for a Next-Gen Battery

Scientists have been working on next-generation batteries for at least a decade and a half, but the work accelerated with the rise of Tesla in the late 2000s and early 2010s. A number of technologies attracted attention, but investors came to focus on a handful of battery innovations—anodes made of lithium metal by Boston-based SES and San Jose, Calif.-based QuantumScape, and solid-state separator startups like those of Colorado-based Solid Power, which is seeking to replace liquid electrolyte with a solid material. But a consensus seemed to develop among EV makers that those technologies were unlikely to be commercially ready until the latter half of the decade at the earliest, and those who wanted to move more quickly turned to silicon anodes.

In 2013, Pluvinage, then heading a small Atherton, Calif., venture capital firm called Invention Capital Partners, bought the battery assets of Nanosys, a Palo Alto company co-founded by Charles Lieber, a Harvard professor who had conceived nanowires for use in semiconductors. Nanosys researchers had begun to expand the work into battery anodes. Pluvinage bought the company’s battery patents and hired its research team, scaling up what had been a laboratory version of the anode into pilot production.

Along the way, Pluvinage realized that the conventional lithium-ion battery was a moving target—its performance kept improving. Silicon, when it was commercialized, could deliver better performance, but the gap with graphite anodes was shrinking; in fact, if you were looking with a harsh eye, there was less and less reason to use silicon. Eventually, Pluvinage decided that graphite was too popular and too entrenched to dislodge, at least this decade and possibly in the 2030s, too. “You already have factories that have been using millions of tons of graphite,” he told me. “To go and replace that is incredibly nuts. It doesn’t make economic sense.”

So Pluvinage lowered his sights and chose to work with graphite rather than against it. His strategy became to replace up to 20% of the graphite in an anode with silicon for starters, which he says will provide up to a 33% boost in energy density and allow a battery to be charged from a 20% state of charge to 80% in about 12 minutes. “You are forced to think about what technology is compatible with the existing supply chain and can be deployed at scale fast,” Pluvinage told me.

Sila Nano CEO Gene Berdichevsky isn’t persuaded that there is any rush to bring his company’s silicon anodes to the mass market. Auto company executives have pushed him, but he thinks they are “quite shortsighted.” EV makers should focus on profits, he said. “You can make money in two ways,” he said. “You can make the cost lower and lower and add nothing new and nothing valuable to the car, and that will increase your margin. Or you can deliver some kind of premium differentiated performance, which consumers are willing to buy.” Berdichevsky tells his automaker customers that he’s initially offering the latter—a product with better performance for which consumers will pay more. He says this strategy is particularly well suited for the most popular vehicles on the road—SUVs, which are heavy and whose drivers generally want a longer-range vehicle.

By 2027 or 2028, Sila will be producing enough anodes to equip around 1 million EVs, Berdichevsky says, and efficiencies will start to kick in that can reduce the cost of an EV. He expects to sell a lot of anodes, starting with Mercedes. “Mercedes makes 2 million vehicles a year,” he says. “You can imagine that technology fitting every electric car they would have over time.”

Devices, Then EVs

Enovix is pursuing a different strategy, aiming initially to place its batteries in portable electronic devices, including smartwatches, smartphones and laptops. The company has said that 20 companies are designing an Enovix battery into one of their electronic devices. It hasn’t named the companies, but it has led analysts to believe that Apple and Meta Platforms are among them. CEO Raj Talluri told me that he expects to be able to charge a premium over graphite batteries. Smartphone buyers pay a lot of money for processors, memory, displays and cameras, he said. “But you aren’t able to use what you’ve already paid for because if you use them at full performance, the battery goes down really fast. If you pay more for the battery, you get a lot more value from things that are already in there.”

Talluri says the same will be true with EVs. People will pay more for a battery that allows a motorist to charge faster and has less risk of catching fire.

I am not certain who is right—Pluvinage, arguing that next-gen players must work with the incumbent, or Berdichevsky and Talluri, certain the market will pay for a better product. I think anyone who tells you they know the answer is wrong; we won’t find out until the second half of the decade at the earliest. I asked Talluri whether when Enovix is ready to go for the EV market, it will be at a disadvantage, since it has to scale up an architecture that’s completely different from how batteries are made today. “This is years out, and once we scale this architecture, we’ll figure out how to build it.…But it’s still to be decided what will be the next-generation EV battery that will be successful. It is to be decided.”

Noteworthy

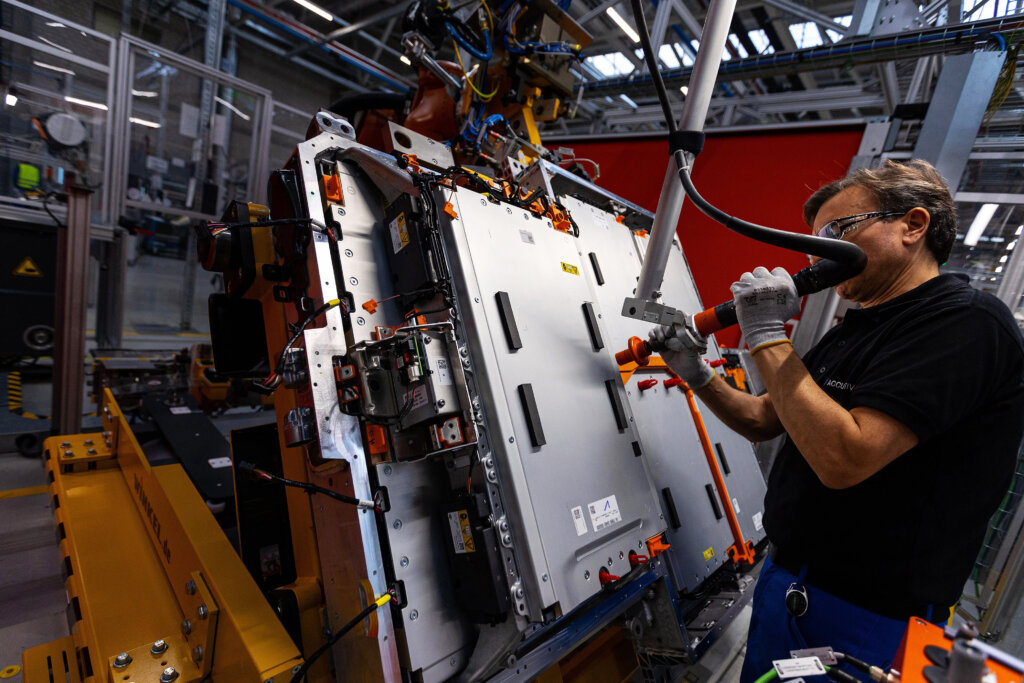

As proof of the intent of major automakers to aim for mass-market EVs, Volkswagen said it will produce a $21,300 EV as early as 2026. That’s in addition to the company’s planned $26,000 model, promised in 2025. It’s not clear yet how VW will achieve these prices, especially if it intends the vehicles to be profitable, but as noted above, all roads lead back to the battery.

Tesla has instigated an EV price war in China, which has spread to Thailand. This battle has forced many of Tesla’s rivals, including Ford, Volkswagen and Chinese manufacturers Byd, Nio and Geely, to slash their prices as well. Since almost everyone except Tesla is losing money on their EVs, the cutthroat competition will be a test of balance sheets.

Lithium-ion suddenly appears to have an authentic rival: Battery factory builders plan more than 100 gigawatt-hours of manufacturing capacity for sodium-ion batteries by 2030, most of it in China, according to Benchmark Mineral Intelligence, a battery metals research firm. Most of the output appears to be headed for the energy storage market, and not EVs, but it will take some of the burden off the strained supply of lithium. It’s an enormous amount of capacity for a battery technology that only recently seemed much further in the future.